[ad_1]

Time period Insurance coverage is an reasonably priced and common type of Life Insurance coverage.

It is sort of a security web that may defend you and your loved ones in opposition to the lack of earnings and safe their way of life, objectives, and aspirations.

On this publish, we are going to talk about time period insurance coverage’s options, advantages, and limitations to grasp what it’s and why buying a time period insurance coverage coverage is a sensible monetary resolution.

On this article:

- What is term insurance?

- Features of Term Insurance

- Benefits of Term Insurance

- What happens if I outlive my term plan?

- Types of Term Insurance

- Why buy term Insurance?

- Limitations of Term Insurance

- How to Choose the Best Term Insurance in UAE?

- Top 5 term plans in the UAE

- How can I know more about Term Insurance?

What’s time period insurance coverage?

Time period Insurance coverage is the only and probably the most reasonably priced type of life insurance. It gives you with life cowl for a particular variety of years. Sometimes between 5 – 40 years.

The duvet quantity, time period, and premiums payable are mounted at first of the coverage.

You’re lined till the top of the time period so long as you retain paying the premiums due. For those who cease paying the premiums, the quilt ceases after a sure grace interval.

Options of Time period Insurance coverage

Selection of Riders:

You’ll be able to improve the scope of your time period plan by including a number of of the next riders;

- Critical Illness Cover

- Everlasting & Whole Incapacity

- Unintentional Whole or Partial Everlasting Incapacity

- Unintentional Demise Profit

- Passive Battle Threat Profit

- Waiver of Premium

- Household Revenue Profit

- Ceaselessly Profit

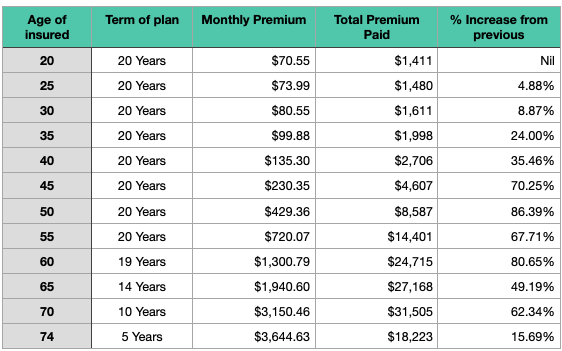

Low-cost when younger

Time period Insurance coverage premiums are low when availed at a younger age, and the premium will increase because the particular person grows older. Therefore children are suggested to avail as much as 10 – 20 occasions of annual earnings as life cowl as early as attainable.

Doing this ensures that your life cowl premiums are locked on the time of buy of the time period insurance coverage.

The next desk exhibits the premiums payable on a Million Greenback life cowl over completely different ages of a non-smoking resident in UAE;

Advantages of Time period Insurance coverage

There are lots of advantages to proudly owning time period insurance coverage, together with:

- Inexpensive premiums: Time period insurance coverage premiums are usually decrease than Whole life insurance premiums. It’s because time period insurance coverage solely gives protection for a selected time period, whereas Complete life insurance coverage gives protection for the insured particular person’s complete lifetime.

- Flexibility: Time period insurance coverage insurance policies could be custom-made to fulfill your particular wants. You’ll be able to select the size of the time period, the quantity of protection, and any riders that you really want.

What occurs if I outlive my time period plan?

For those who outlive your time period insurance coverage, then you aren’t getting again any premiums you paid into the coverage.

It’s a lot much like renting a home. You’ll be able to reside in it so long as you pay the hire agreed upon. For those who cease paying hire, then you could be evicted. Whenever you vacate the home, you aren’t getting again the hire paid.

Forms of Time period Insurance coverage

1. Stage Time period Life Insurance coverage

Your life cowl quantity stays the identical all through the time period of the plan.

With stage time period assurance, premiums are mounted at some point of the plan.

It’s usually used to guard in opposition to lack of earnings, as key particular person cowl to guard enterprise continuity.

2. Decreasing Term Life Insurance

The duvet quantity reduces by a hard and fast quantity every year, ending up at zero by the top of the time period.

As a result of the quilt quantity reduces, the premiums on this kind of coverage are decrease than level-term insurance policies.

Individuals often purchase reducing time period insurance policy to guard a mortgage, the place the quantity of canopy reduces with the mortgage excellent.

Any such time period assurance is inexpensive than stage time period assurance.

Why Ought to You Purchase Time period Insurance coverage?

There are lots of the reason why you would possibly wish to purchase time period insurance coverage, together with:

-

It’s easy to grasp and simple to arrange. No frills, no confusion.

-

Straightforward in your price range – You should purchase time period insurance coverage in UAE for as little as AED65 a month.

-

The life insurance coverage premiums are mounted all through the time period of the plan.

-

Not the elephant within the room – You may also afford to put money into different monetary objectives due to the low premiums.

-

You’ll be able to add riders like vital sickness advantages, incapacity cowl, Waiver of Premium, and many others.,

-

It gives international safety – Endowment and Complete of Life plans might not be tax compliant within the USA. So if you wish to migrate to the USA, the time period plan is right.

-

The declare proceeds of time period insurance coverage are tax-exempt in lots of nations.

Limitations of Time period Insurance coverage

The two essential drawbacks are as follows;

Mounted time period

The time period of protection is mounted on the outset of the plan. You could be unable to extend the time period if crucial.

You need to fastidiously contemplate many future circumstances when deciding the time period of protection for such insurance policies.

For those who select a shorter time period, your loved ones’s earnings or commitments are in danger, and should you select an extended cowl time period than required, then you find yourself paying larger premiums.

No Money Give up Worth

As mentioned above, there isn’t a money give up worth whenever you outlive the plan. Whereas this function makes the time period plans reasonably priced, you could find yourself spending extra whenever you select an extended protection time period.

Select the Greatest Time period Insurance coverage in UAE?

If you’re contemplating time period insurance coverage, evaluating completely different insurance policies and discovering one which meets your wants is vital. You must also speak to a monetary advisor to get their recommendation on whether or not or not time period insurance coverage is best for you.

Listed below are some issues to think about when selecting time period insurance coverage:

The quantity of protection

The primary and most important step is figuring out how a lot life cowl is right to guard your loved ones’s way of life and objectives.

The size of the time period

The size of the time period will decide how lengthy you can be lined. In case you have younger kids, you could wish to contemplate a long term in order that your loved ones will likely be protected for so long as attainable.

The riders

Riders are elective add-ons that may present further advantages, similar to protection for vital sickness or unintentional dying.

How are the Premiums Calculated?

The Premiums are primarily based on the next;

- Your age

- State of your well being

- Quantity of canopy chosen

- Coverage Time period

- Riders Chosen

- Nationality

- BMI

- Journey historical past and future journey plans

Prime 5 time period plans in UAE

Now that you simply perceive the scope and advantages of Time period Insurance coverage within the UAE, we are able to have a look at the Prime 5 plans from numerous insurance coverage corporations.

- International Term Assurance(ITA) from Zurich International Life Ltd.

- Live Life from MetLife

- International Protector Middle East(IPME) from FPI

- Option 4 – Lifeguard – from Oman Insurance

- Hemaya Plus – Family Takaful Term Plan from Salama

How can I do know extra about Time period Insurance coverage?

As a monetary advisor with greater than 10 years of expertise working with 350+ households, I might help you confirm how a lot life cowl you want, for the way lengthy you want it, and what riders you must select.

Organize a Free Session to debate your safety wants and safe your loved ones’s monetary future.

Click here to connect with me.

[ad_2]