[ad_1]

First Quarter 2024 in Evaluation

The U.S. financial system has decelerated from the 4.9% fee of progress within the third quarter of 2023 and is on observe to increase at a fee of about 2.8% within the first quarter of 2024, in line with the GDP Now forecast from the Federal Reserve Financial institution of Atlanta. Inflation is operating a bit larger than the Federal Reserve’s 2% goal, or roughly 3.2% year-over-year in February. As well as, the financial system added roughly 250,000 jobs monthly in 2023 and appears to proceed this tempo of job creation up to now in 2024. Because of this, traders have begun to anticipate a comparatively good financial system in 2024, although the sustained inflation has decreased the opportunity of short-term fee cuts and pushed up longer-term rates of interest modestly.

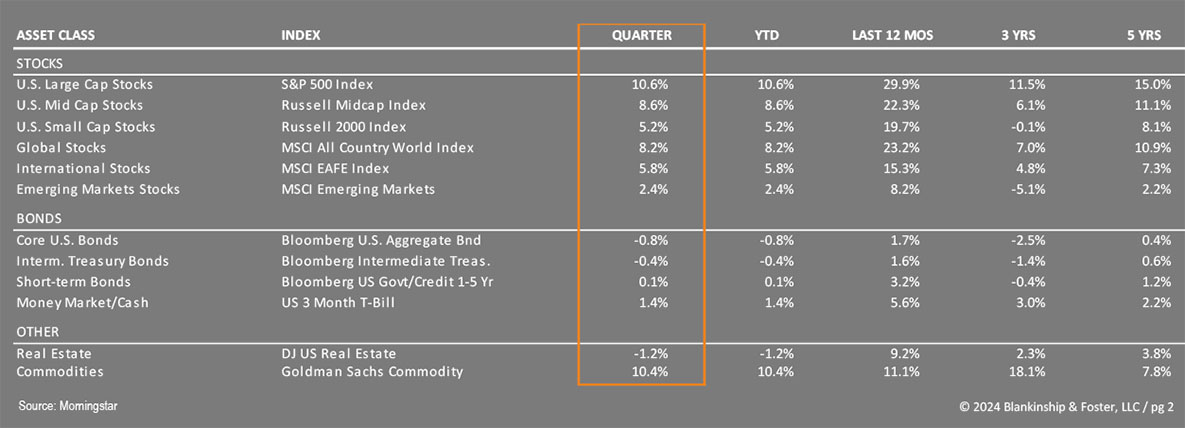

This investor optimism propelled the inventory market larger within the first quarter, with the S&P 500 Index of enormous U.S. firms gaining 10.6% for the primary three months of the yr. The Russell 2000 Index of small firm shares climbed 5.2%. Worldwide shares, represented by the MSCI EAFE index, gained 5.8% in greenback phrases however 10.0% in native forex phrases as a rising greenback took a chunk out of overseas inventory efficiency throughout the quarter. The bench- mark 10-year Treasury yield ended the yr at 3.88% however rose to 4.33% by April 1. Because of this, the Barclay’s US Mixture Bond Index (representing the whole bond market) fell 0.8% throughout the quarter (bond costs fall when rates of interest rise). Excessive Yield “junk” bonds gained 1.5% whereas commodities had been up 10.4%, pushed largely by copper and oil. The Dow Jones US Actual Property Index misplaced 1.2% as traders fretted over rising rates of interest.

Economic system

As we’ve written, Gross Home Product rose at a 3.4% annual tempo within the fourth quarter of 2023 and grew roughly 2.5% throughout the full yr, properly above the two% annual pattern since 2000. Whereas decelerating into 2024, the consensus appears to be that the financial system is more likely to keep away from recession, at the very least in 2024 and is probably going on observe for an annual acquire of about 2.4% for the yr.

Client spending, which accounts for roughly two-thirds of the U.S. financial system, continued to develop final yr with solely gentle cautionary indicators heading into the second quarter of 2024. Auto and bank card delinquencies are rising, although not but to the degrees seen earlier than the 2007 recession, and family debt service (money owed as a p.c of disposable revenue) continues to be beneath pre-pandemic ranges. The labor market stays tight however wage progress has slowed to extra regular ranges, dampening the stress on inflation however nonetheless supporting modest client spending. Company earnings could come beneath stress as lending requirements tighten, wages rise and rates of interest stay elevated, however even with a slowing (quite than stalling) financial system, earnings ought to stay constructive.

The labor market stays sturdy with round 250,000 jobs created each month in 2023 and more likely to proceed at this tempo in 2024. Elevated authorized immigration has helped to offset what would in any other case create upward stress on wages (and thus inflation).

On that be aware, inflation has been hovering the three.3% mark up to now in 2024, chilling investor expectations for rate of interest cuts from the Federal Reserve, pushed by larger power costs, housing and companies like healthcare and transportation. There may be some expectation {that a} mixture of recovered provide chains, new multi-unit housing growth and slowing financial progress ought to proceed to place downward stress on costs. Even so, it now appears unlikely the Fed will lower rates of interest earlier than the November election until one thing goes critically incorrect. That expectation has pushed the 10- yr Treasury again as much as round 4.4%, leading to losses once more for bond portfolios and a slight lack of enthusiasm amongst inventory traders.

With a slowing however in any other case robust financial system, recession doesn’t appear to be within the playing cards this yr, so any downturn in inventory markets needs to be short-lived, barring some type of financial or coverage shock.

Abroad circumstances are one thing of a combined bag. China and Europe are trying a bit weak whereas Japan and non-China rising markets like India did higher. The tip of destructive actual (after-inflation) rates of interest in Japan has created optimism there whereas China continues to wrestle to get again on its ft following the pandemic and a few high-profile property and banking challenges whereas authorities crackdowns trigger unease amongst world traders. Europe additionally suffered from weak consumption and enterprise confidence, as evidenced within the Buying Supervisor Indexes. Reforms in India have pushed enlargement of its center class and highly effective financial progress consequently.

Outlook

Struggle in Ukraine. Struggle within the Center East. Rising oil costs. Excessive housing costs. Inflation continues to be hovering above 3 p.c. Mortgage charges are above 6 p.c. And a presidential election that few wished. It’s stated that the inventory market typically climbs a wall of fear and traders have a lot to fret about as of late.

Progress is anticipated to sluggish throughout the yr, making the financial system extra prone to shocks or coverage errors. However with the prospect of a recession seemingly decreased, inventory markets ought to proceed to rise throughout the yr, although maybe not eventually yr’s extraordinary tempo.

Within the soft-landing state of affairs, financial progress would sluggish sufficient to tame inflation however not sufficient to trigger a recession, leading to sustained (however very gentle) progress, low unemployment and continued energy in client

spending. If this occurs, the Fed could have to chop charges a bit so as to preserve the momentum, however charges may stay larger for longer. Shares would additionally profit from decrease short-term charges and improved confidence and would possible see robust features.

If a recession happens, it could possible end in a pointy drop in inventory costs and steep cuts in rates of interest as properly, so allocations to fastened revenue (bonds) ought to considerably offset losses in inventory and actual property holdings. Whereas a recession may be gentle or short-lived, the volatility would possible be pronounced, particularly since so few shares have contributed to the features seen within the S&P 500 this previous yr.

Within the fastened revenue markets, traders had priced in six rate of interest cuts originally of the yr. Through the first quarter, rates of interest rose as traders recalibrated their expectations to cost in three cuts as inflation stays stubbornly above the three% degree. Whereas we don’t anticipate additional will increase in rates of interest, the Federal Reserve isn’t more likely to lower charges till progress or inflation comes down considerably.

Our Portfolios

Our outlook (and therefore our portfolio positioning) hasn’t modified materially prior to now a number of weeks. Our inventory publicity is at present broad based mostly and weighted in the direction of giant U.S. firms. Although we’ve got decreased our publicity to smaller firms, there’s nonetheless fairly a bit in our core market funds so the underperformance there was a little bit of a drag on returns. We’re properly positioned for financial enlargement, but when a recession does happen we’d anticipate our giant firm inventory (and worth bias) to carry up considerably higher than the broad inventory market. Our worldwide publicity stays balanced between hedged and unhedged investments and advantages from extra enticing valuations than comparable U.S. equities.

At the moment’s larger rates of interest imply that anticipated bond returns going ahead are extra enticing than they had been two years in the past. Extra importantly, if a recession happens, rates of interest will possible settle again down, offering good returns to bonds as shares falter.

This yr, we anticipate volatility as traders grapple with a number of potential dangers and shocks, together with the opportunity of a recession. We’ll use such durations of volatility to rebalance portfolios and decide up shares (or bonds) at discounted costs, to raised revenue from the restoration that has adopted each single market decline for so long as there have been markets.

As all the time, we’re right here for you and are prepared to supply the steering and planning you anticipate from us. You probably have any questions on your investments or your monetary plan, we’d love the chance to debate them with you.

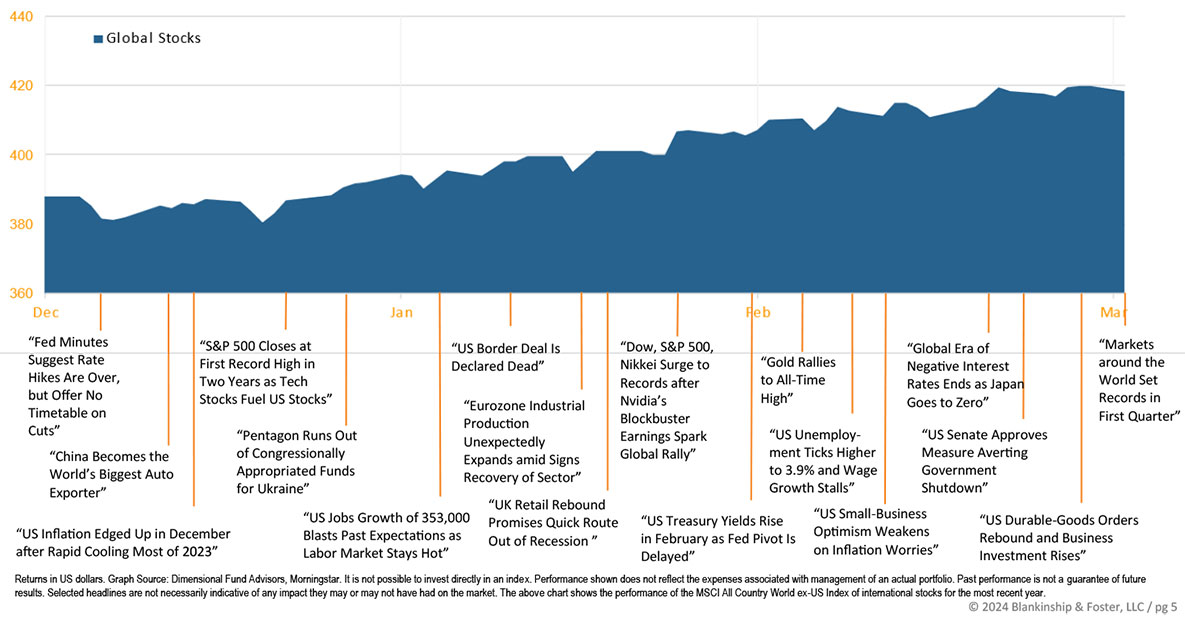

International Inventory Market Efficiency

The chart beneath exhibits the change in world fairness markets all through the quarter. Juxtaposed over the market efficiency are a few of the key occasions that occurred throughout the interval. Typically as we get to the top of a unstable interval, it’s troublesome to look again and keep in mind every part that occurred alongside the way in which.

Previous efficiency is just not a sign of future returns. Info and opinions offered herein mirror the views of the writer as of the publication date of this text. Such views and opinions are topic to vary at any level and with out discover. A number of the data offered herein was obtained from third-party sources believed to be dependable however such data is just not assured to be correct.

The content material is being offered for informational functions solely, and nothing inside is, or is meant to represent, funding, tax, or authorized recommendation or a suggestion to purchase or promote any kinds of securities or investments. The writer has not thought of the funding goals, monetary state of affairs, or specific wants of any particular person investor. Any forward-looking statements or forecasts are based mostly on assumptions solely, and precise outcomes are anticipated to fluctuate from any such statements or forecasts. No reliance needs to be positioned on any such statements or forecasts when making any funding resolution. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a tenet. No funding resolution needs to be made based mostly solely on any data offered herein.

There’s a threat of loss from an funding in securities, together with the danger of whole lack of principal, which an investor will should be ready to bear. Various kinds of investments contain various levels of threat, and there might be no assurance that any particular funding will likely be worthwhile or appropriate for a specific investor’s monetary state of affairs or threat tolerance.

Blankinship & Foster is an funding adviser registered with the Securities & Alternate Fee (SEC). Nonetheless, such registration doesn’t indicate a sure degree of ability or coaching and no inference on the contrary needs to be made. Full details about our companies and charges is contained in our Type ADV Half 2A (Disclosure Brochure), a replica of which might be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our web site at www.bfadvisors.com.

[ad_2]