[ad_1]

There was an unprecedented erosion in bond values in 2022. Now we have not seen such a crash within the final two centuries!

Historically bonds play the function of a lifebuoy when the inventory markets sink. Final yr was an exception when even the bonds went down with the shares.

Why did the bonds go down in worth?

Bond costs crashed final yr because the U.S. Federal Reserve aggressively raised rates of interest to struggle inflation.

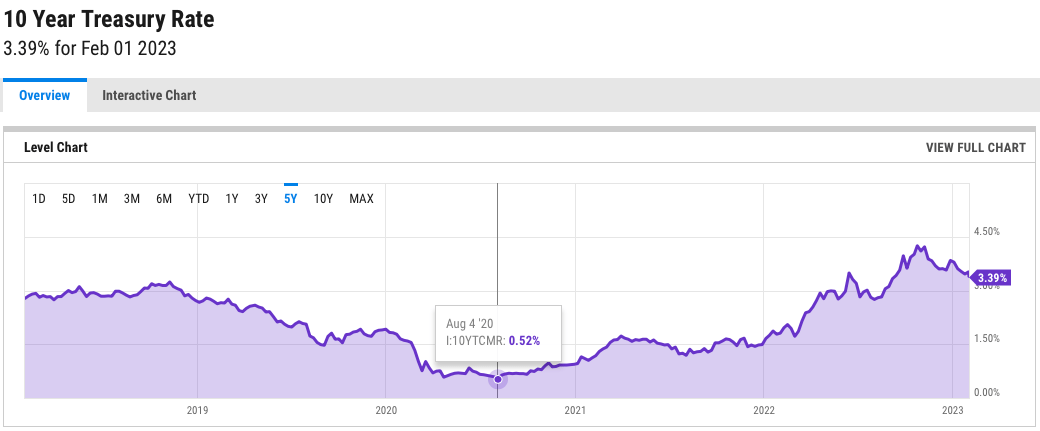

During the last yr, the Fed has raised charges from zero to nearly 5 p.c. On the similar time, 10-year bond yields have elevated from 0.52% in 2020 to three.39% in 2023.

What’s the connection between rates of interest and bond values?

Usually bond costs have an inverse relationship with rates of interest. Bond costs go down when the rates of interest go up and vice versa.

Think about you and your folks collectively owned properties in a neighborhood. There’s a new neighborhood developed close by the place the rental yields are greater than yours.

Individuals searching for a better rental earnings would promote the property in your neighborhood and flock to purchase within the new neighborhood. Consequently, the costs of your neighborhood will begin falling to the extent the place the rental yields are much like the brand new neighborhood.

That is exactly what is going on within the bond markets.

When bond costs go up, the worth of the bonds you and others already maintain will lower as a result of individuals will begin promoting them to purchase new bonds that supply greater curiosity on the cash lent.

Then again, when rates of interest begin falling, current bonds shall be extra in demand as a result of they’ll provide a better return than the brand new bonds being issued.

Are bonds no extra a protected haven?

Contemplating that the International bond market was $126.9 trillion as of 2022, it’s too massive to stay risky for an prolonged interval.

Additionally, inflation roughly peaked, and the speed of enhance of rates of interest has come down; we anticipate the return of sanity within the bond markets shortly.

Additionally, given the sharp discount in bond costs, it may be a possibility for long-term traders.

Click on here to be taught extra about bonds.

[ad_2]