[ad_1]

Quarter in Evaluation

Financial development within the third quarter seems to be to have been sturdy, with the Federal Reserve Financial institution of Atlanta’s GDP Now forecast operating at round 4.9% for the quarter. That indicator has a blended file, so take that with a grain of salt, however with easing inflation, resilient enterprise funding, and strong shopper spending, the quarter is wanting optimistic. That mentioned, there are indicators of slowing momentum as we head into the vacation spending season, and capital markets appear to be having a tricky time deciphering the financial crosscurrents. Volatility often is the theme for the remainder of the yr.

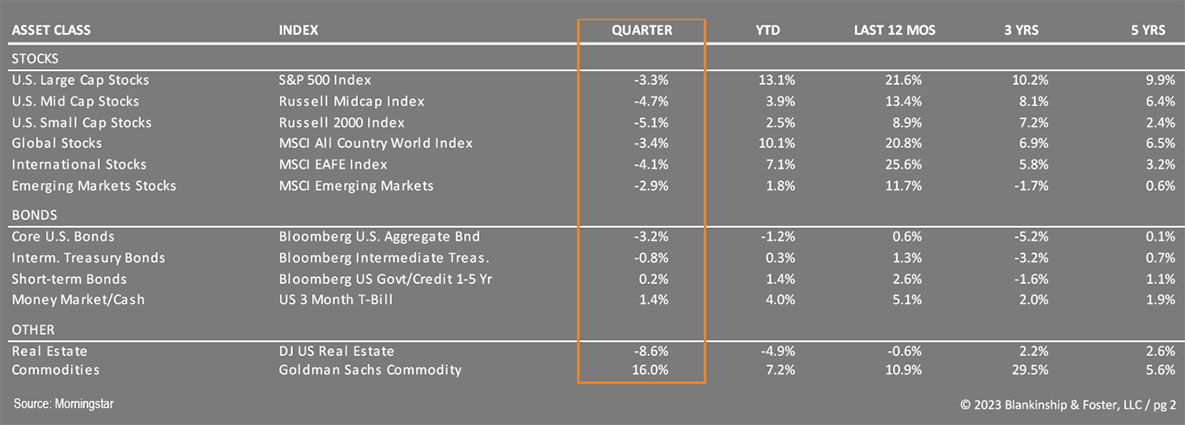

The inventory market rally sputtered a bit within the third quarter, with the S&P 500 Index of huge U.S. firms falling 3.3% for the quarter, although nonetheless up 13.1% year-to-date. The Russell 2000 Index of small firm shares fell 5.1% and is up 2.5% for the yr. Worldwide shares, represented by the MSCI EAFE index, fell 4.1% throughout the quarter on financial weak point in Asia and Europe. The bond market has been unstable, swing between optimism that rate of interest hikes had been over and acceptance that extra had been to come back. Additionally, elevated promoting of Treasury bonds by central banks all over the world

(together with the Federal Reserve) has put upward strain on rates of interest. The benchmark 10-year Treasury yield ended the third quarter at 4.59%, up significantly from 3.81% on June 30. Consequently, the Bloomberg US Mixture Bond index fell 3.2% throughout the quarter and is down 1.2% year-to-date. Excessive Yield “junk” bonds held regular at 0.5% for the quarter and up 6.0% for the yr. The Dow Jones US Actual Property Index, which tends to be extra delicate to adjustments in rates of interest, dropped 8.6% throughout the third quarter.

Financial system

Gross Home Product rose at a 2.1% tempo within the second quarter and is probably going on monitor for a stronger outcome throughout the third quarter. As famous already, enterprise funding has proved resilient regardless of tighter lending requirements and better rates of interest. It stays to be seen whether or not firms can preserve excessive revenue margins.

Shopper spending has additionally remained sturdy, supported by a decent labor market and actual wage development since 2020. That mentioned, private financial savings charges have plummeted whereas revolving credit score has elevated. They’re not wanting overextended simply but, however delinquencies are beginning to rise. On condition that it takes about 12-18 months for the total influence of a change in rates of interest to move by way of the economic system, we’re anticipating the Federal Reserve’s 18 months of elevating rates of interest to begin taking a chunk out of non-public consumption, particularly when mixed with different elements like pupil mortgage funds resuming and better vitality costs.

Total, the economic system ought to proceed to develop at a average, however slowing tempo. Slower development does make the economic system extra prone to unfavorable shocks, and one prediction mannequin from the Federal Reserve Financial institution of New York means that the chance of a recession twelve months from now could be primarily a coin toss.

The labor market has remained remarkably sturdy, regardless of rising rates of interest. But it additionally reveals indicators of cooling because the tempo of month-to-month job beneficial properties has been trending decrease. The participation fee of prime age employees (25 to 54) has absolutely recovered to pre-pandemic ranges, however participation for older employees has not, reflecting child boomers who’ve left the workforce completely. Different labor market indicators recommend that job development could proceed to decelerate within the coming months. Regardless of the power in employment, wages broadly haven’t stored up with rising costs since 2020, so even the 4.5% acquire of the previous 12 months shouldn’t put upward strain on inflation. A softening labor market additional limits upward strain on wages heading into subsequent yr.

Inflation has cooled since final yr. Lots of the elements that contributed to final yr’s worth will increase have moderated. Costs rose 3.7% year-over-year in August, down from 9.7% in June 2022. Shelter inflation, the most important single contributor to larger costs, has begun to average and slowing lease development ought to proceed to place downward strain on inflation. Power costs also needs to pattern decrease as we head into the winter, absent an enlargement of the present battle in Israel. We anticipate headline inflation to say no to round 3% by yr finish, and probably again to round 2-2.5% by the top of subsequent yr. Consequently, the Federal Reserve might be able to cease elevating rates of interest. The query then turns into how quickly they’ll start to decrease short-term rates of interest. This will likely be pushed by how shortly the economic system cools, and whether or not or not we’re in a position to keep away from a recession (the proverbial “gentle touchdown”). If a recession does happen, the Fed will likely be pressured to decrease rates of interest extra quickly.

Abroad, China’s lifting of COVID insurance policies has created considerably of a rebound in shopper spending, offset by challenges of their actual property sector. In Europe, inflation stays a difficulty, compounded by weak manufacturing sentiment. India stays a vivid spot, as does Japan with bettering wage development after 30 years of weak point. Valuations of abroad equities stay engaging in comparison with U.S. shares.

Outlook

The consensus appears to level to a recession starting someday in 2024 or 2025, reasonably than later this yr. Traders barely seen two main shocks at the start of this quarter (the ouster of Kevin McCarthy as Speaker of the Home and the shock assaults by Hamas in Israel), suggesting traders are extra centered on the Federal Reserve and rates of interest.

Wanting ahead, present valuations on shares stay considerably engaging in comparison with current historical past, although development inventory valuations are a bit stretched. Regardless that shares have risen this yr, bond markets have priced in a reasonably vital discount in rates of interest, signaling an expectation of a recession within the coming quarters. We might not be stunned by a drop in inventory costs on financial weak point, adopted by a powerful restoration by the top of 2024, although different eventualities are additionally potential.

One factor that may be a bit disconcerting is simply how slim the inventory market efficiency has develop into, which means that the beneficial properties we’re seeing within the indexes are actually powered by only a handful of huge (principally tech) firms. This conduct is usually noticed late in a bull market. Extra to the purpose, it’s almost unimaginable to time inventory market actions like we’ve described above. For instance, traditionally, durations when shoppers really feel the worst in regards to the economic system have been a few of the finest occasions to purchase shares. Fairness costs are prone to be unstable this yr as traders weigh the influence of a looming (or prevented) recession and negotiations in Washington round funding the federal government for 2024, amongst different geopolitical considerations.

Our Portfolios

Our outlook (and therefore our portfolio positioning) hasn’t modified materially up to now a number of weeks. Our inventory publicity is at the moment broad based mostly and weighted in direction of giant U.S. firms. Our price bias, which helped final yr as high-flying development firms struggled with rising rates of interest, has been a little bit of a detractor this yr as traders have shrugged off excessive rates of interest and paid up for the shares of firms which are displaying earnings development. If a recession does happen, we might anticipate this pattern to reverse once more, and people larger P/E (costly) shares ought to fall tougher than the remainder of the market. Our worldwide publicity stays balanced between hedged and unhedged investments and advantages from extra engaging valuations than comparable U.S. equities.

At present’s larger rates of interest imply that anticipated bond returns going ahead are extra engaging than they had been a yr in the past. Extra importantly, if our expectation of a recession is realized, rates of interest will probably settle again down, offering good returns to bonds ought to shares falter heading right into a recession. Bonds ought to be a greater diversifier this yr, particularly if markets are right in forecasting decrease rates of interest in 2024. Even when that expectation is unrealized, longer-term rates of interest have risen fairly a bit already and are unlikely to rise considerably from right here.

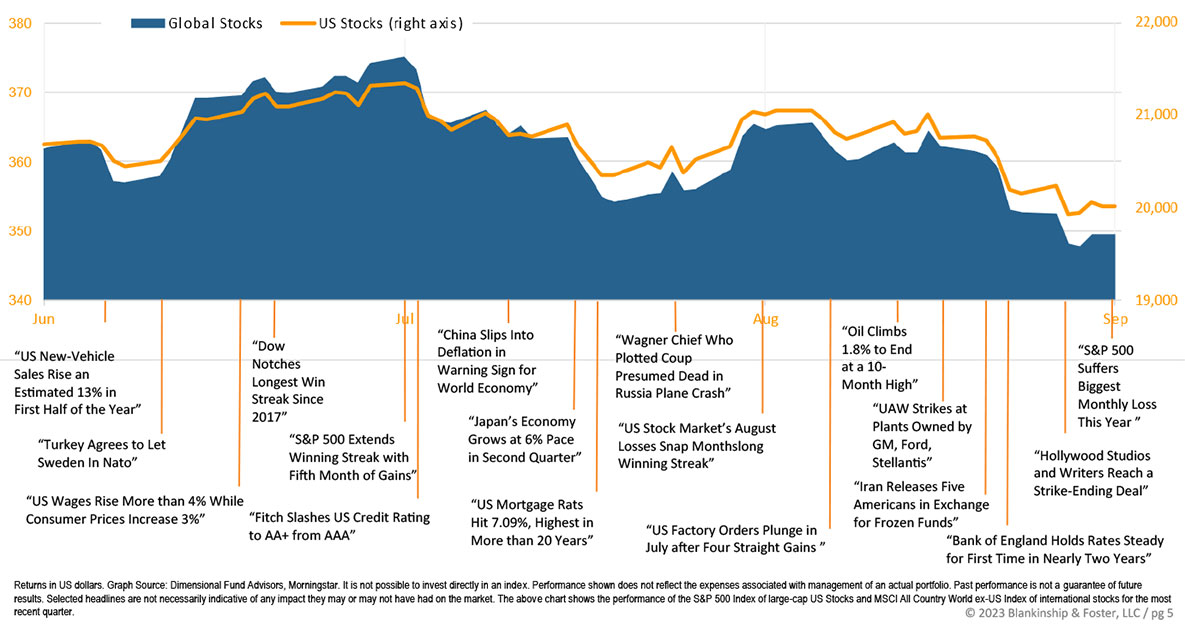

World Inventory Market Efficiency

The chart under reveals the change in world fairness markets all through the quarter. Juxtaposed over the market efficiency are a few of the key occasions that occurred throughout the interval. Generally as we get to the top of a unstable interval, it’s troublesome to look again and keep in mind all the things that occurred alongside the way in which.

Briefly, we proceed to anticipate volatility as traders put together for a potential recession and regulate their estimates for inventory costs accordingly. We’ll use such durations of volatility to rebalance portfolios and choose up shares (or bonds) at discounted costs, to higher revenue from the restoration that has adopted each single market decline for so long as there have been markets.

As all the time, we’re right here for you and are prepared to supply the steering and planning you anticipate from us. You probably have any questions on your investments or your monetary plan, we might love the opportunity to discuss them with you.

Previous efficiency will not be a sign of future returns. Info and opinions supplied herein replicate the views of the writer as of the publication date of this text. Such views and opinions are topic to alter at any level and with out discover. Among the info supplied herein was obtained from third-party sources believed to be dependable however such info will not be assured to be correct.

The content material is being supplied for informational functions solely, and nothing inside is, or is meant to represent, funding, tax, or authorized recommendation or a advice to purchase or promote any forms of securities or investments. The writer has not thought of the funding targets, monetary scenario, or explicit wants of any particular person investor. Any forward-looking statements or forecasts are based mostly on assumptions solely, and precise outcomes are anticipated to differ from any such statements or forecasts. No reliance ought to be positioned on any such statements or forecasts when making any funding determination. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a tenet. No funding determination ought to be made based mostly solely on any info supplied herein.

There’s a threat of loss from an funding in securities, together with the danger of whole lack of principal, which an investor will should be ready to bear. Several types of investments contain various levels of threat, and there may be no assurance that any particular funding will likely be worthwhile or appropriate for a specific investor’s monetary scenario or threat tolerance.

Blankinship & Foster is an funding adviser registered with the Securities & Alternate Fee (SEC). Nevertheless, such registration doesn’t indicate a sure stage of talent or coaching and no inference on the contrary ought to be made. Full details about our providers and costs is contained in our Type ADV Half 2A (Disclosure Brochure), a duplicate of which may be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our web site at www.bfadvisors.com.

[ad_2]