[ad_1]

London is among the many worst UK areas for predicted post-retirement monetary wrestle, a brand new examine by Scottish Widows has predicted, writes Emily Berry.

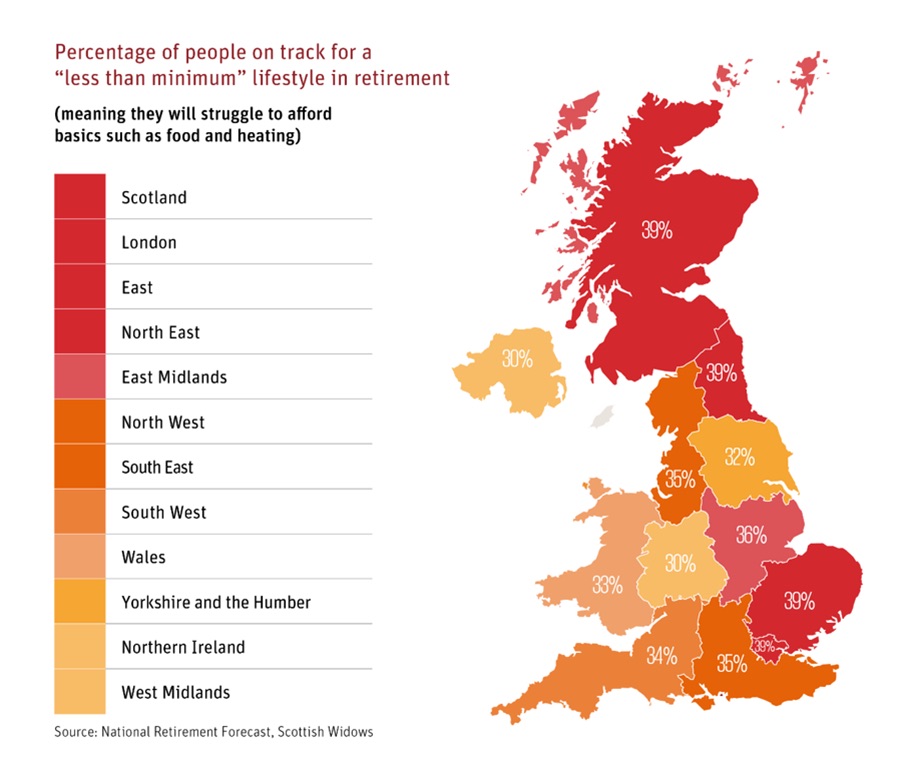

In response to the examine, practically 4 in 10 retirees in London, Scotland, the North East and East of England will wrestle to satisfy minimal residing prices in retirement.

The examine suggests 39% of Londoners are on monitor for ‘lower than the minimal’ retirement revenue. Scottish Widows says this group of impoverished pensioners will wrestle to afford primary necessities equivalent to meals and heating.

The forecasts are made within the pension supplier’s newest Nationwide Retirement Forecast Examine, launched to help of a marketing campaign by the Pension and Lifetime Financial savings Affiliation commerce physique (PLSA) this autumn to boost consciousness of the looming pension disaster dealing with many in retirement.

Scottish Widows: Nationwide Retirement Forecast Examine Sept 2023 / regional forecasts

The Pension and Lifetime Financial savings Affiliation (PLSA) defines the ‘minimal revenue’ wanted for a single pensioner in retirement as £12,800. Pensioners ought to goal an revenue of £23,300 each year for a average retirement and £37,300 for a cushty revenue, in accordance with PLSA estimates.

Other than London, different UK areas the place retirees are set to fail to achieve the minimal revenue in retirement are Scotland, the North East and East of England with 39% of retirees anticipated to obtain lower than the minimal retirement revenue wanted once they retire.

Northern Eire and the West Midlands had the bottom determine of retirees dealing with lower than minimal required pensions however even right here 30% of individuals had been dealing with poverty in retirement.

The examine additionally discovered that Londoners had been additionally the probably to lease their houses than wherever within the UK, with 35% renting. Based mostly on the forecasts, London ‘minimal revenue’ retirees are prone to see rental funds consuming 131% of their retirement revenue, a UK excessive. Even within the East of England, the place rents are decrease, retirees who lease will discover 98% of their cash consumed by rental prices if they’re on minimal retirement revenue.

Scottish Widows is advising employees to avoid wasting no less than 15% of their wage together with employer contributions and tax aid for his or her pension, in an effort to have an honest retirement life-style.

The examine has been launched as a part of the PLSA’s Pension Engagement Season marketing campaign encouraging pension savers to take a critical have a look at their projected retirement revenue.

Peter Glancy, head of coverage at Scottish Widows, stated: “The uncomfortable reality is that folks throughout the UK should not managing to avoid wasting sufficient for retirement and a few proceed to go alongside unaware once they may very well be taking some easy steps to make an enormous distinction to their monetary future.”

[ad_2]