[ad_1]

Are you trying to get essentially the most out of your Zurich Futura plan?

Successfully managing your coverage’s efficiency is essential to the sustainability of your plan for the “Complete Life”.

On this submit , I’ll break down the important steps to boost your zurich futura fund efficiency. I am going to cowl every little thing from selecting the best charge of return to understanding the advantages of Greenback-Price Averaging, and the way common critiques can hold your plan on observe.

Whether or not you are trying to purchase a brand new coverage or trying to optimize your present plan, this text offers sensible suggestions and professional recommendation that will help you make knowledgeable selections.

Uncover learn how to steadiness your safety wants along with your price range, and discover ways to modify your plan to fit your altering monetary targets.

Zurich Futura Fund Efficiency – Fable & Actuality

Many coverage holders assume that the fund efficiency solely impacts the money give up worth of the plan. That is removed from actuality.

Really, the fund efficiency is a key side of this plan it impacts each the money worth and the way lengthy the plan sustains the advantages you might have chosen.

Your coverage will maintain for “Whole Life” provided that the funding grows on the charge chosen on the illustration.

Additionally the money give up worth will solely obtainable whenever you give up the advantages of the plan.

How does it work?

Zurich Futura is a unit-linked insurance coverage plan.

It goals to offer a canopy for Complete Life, the place the premium fee time period may very well be for 10, 15, 20 or extra years. The premiums after prices are allotted in funding funds to develop in worth.

The price of insurance coverage is deducted out of your account worth of your plan.

Though, Zurich Futura is made to resist intermittent market volatility; the duvet may stop; if the account worth grew to become zero attributable to nonpayment of premiums or attributable to antagonistic market situations or inefficient fund choice or administration.

Having stated that, this may be averted by managing your plan successfully.

How you can enhance Zurich Futura Fund Efficiency?

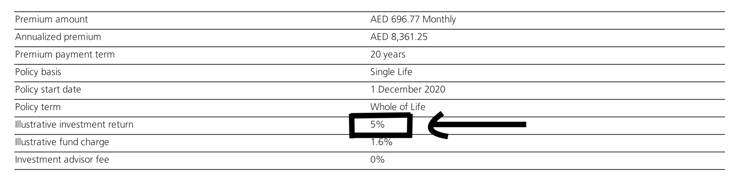

Fee of Return

Step one is selecting an acceptable charge of return, in step with your danger urge for food; whereas calculating the premiums. Focus on along with your financial advisor the impression of investing at a better or decrease charge in your money worth or sustainability of the plan.

A really perfect vary is between 5% – 7%.

Your premiums will go up for those who select a decrease development charge and vice versa.

Ask your adviser to indicate you completely different choices with a decrease /increased charge of return and premium fee phrases.

Do not simply settle with the choices offered by your advisor.

Spend a while to grasp how the plan works and interact in customizing your plan to fit your wants and money flows.

If you have already got a Futura plan, you possibly can nonetheless restructure it to fit your safety wants and danger urge for food.

On-line Entry

Acquire on-line entry to your plan. Now they’re all an app obtainable. Download the app to have easy access to your account.

Click on here to register your on-line account and monitor your coverage

Monitor your Zurich Futura Fund Efficiency on half yearly or yearly foundation, and focus on along with your advisor if the fund efficiency just isn’t on top of things.

Zurich fund center is a repository of all the mandatory details about varied funds obtainable to speculate throughout the Futura plan.

You could find a variety of helpful data and fund factsheets whenever you entry the Fund Centre. Learn to use it.

The next are a number of the Investments obtainable on Zurich Futura Plan

- Zurich Managed Funds like US dollar Blue Chip, US dollar Performance

- Fairness Funds for development of capital – Investing in Technology, Health Science and different outstanding funds

- Bond Funds to guard capital – Investing in Sovereign, Company and Excessive Yield Bonds

- Commodities Funds – Investing in precision metals like Gold and Silver

- Blended Asset Funds – Investing in a Mix of Fairness, Bonds, Commodity and Property

You’ll be able to choose the funds that align along with your danger appetie and the expansion charge chosen in your illustration.

Studying this text will help you construct a sturdy funding portfolio on the Futura; Mutual funds in UAE – How to build a robust portfolio?

Common Evaluation

As soon as the plan is about up, proactive administration of the funding funds is crucial. Speak to your advisor frequently and overview your plan not less than yearly, if no more.

Bench mark the efficiency of the plan along with your illustration to find out whether it is on observe.

It lets you perceive if the expansion is in step with the projections and make vital amendments to the funding technique.

In case your advisor just isn’t useful; please discover one who can handle your plan successfully.

Greenback-Price Averaging(DCA)

Perceive the idea of Greenback Price Averaging and use it to your profit, with the assistance of your monetary advisor.

The next video will clarify DCA

Do not panic

When the markets go down, they for certain will. Do not panic and make hasty selections. Analyze the state of affairs rigorously, it can be a possibility to proceed investing in a specific market/fund.

The extra you be taught and apply the most effective funding ideas higher your Futura plan will carry out. It can additionally aid you properly make investments in your different monetary targets like retirement, kids’s schooling, and so forth..

Knowledgeable Assist

For those who really feel overwhelmed with the funding course of, do not hesitate to hunt professional assist.

I handle a portfolio of greater than 300 Futura plans, and I’ve helped many ex-pats restructure their Futura in step with their safety wants and price range. I will help you as properly.

You’ll be able to organize a Free Preliminary Assembly with me that will help you analyze, amend and successfully handle your plan.

[ad_2]