[ad_1]

Understanding Life Insurance coverage

Within the UAE, life insurance coverage is greater than a coverage—it is a security internet to your family members. It is the peace of mind that your loved ones can have monetary assist, making certain their life can go on, even in the event you’re not there.

The Significance of Life Insurance coverage in Dubai and UAE

Life insurance coverage is essential within the UAE, It’s about offering for your loved ones’s residing bills, education and retaining their desires alive, even in your absence. From each day bills to future objectives, life insurance coverage ensures that your loved ones’s journey continues easily.

Forms of Life Insurance coverage Accessible within the UAE

The next are the three main forms of life insurance coverage within the UAE

- Term Life Insurance – Affordable, fixed-term coverage for peace of mind.

-

Whole of Life Insurance – Offering safety for a lifetime with money worth - Endowment Plans – A mixture of financial savings and insurance coverage, supporting future monetary objectives.

The first objective of every kind of plans is to supply lump-sum money to your loved ones, serving to you safe their future within the unlucky occasion of your demise.

Advantages of Having a Life Insurance coverage Coverage within the UAE

The Position of Life Insurance coverage in Joint Earnings Households

Marriage unites two individuals in a shared journey of pleasure, challenges, and mutual monetary tasks.

Within the UAE, {couples} typically plan their lives round their mixed incomes. This may embody loans for a dream dwelling, a household automobile, or memorable holidays.

However, if tragedy strikes and one companion passes away, the surviving partner faces not simply heartbreak but additionally the daunting activity of managing money owed and residing bills alone.

Life insurance coverage within the UAE steps in throughout these essential instances, providing important monetary assist and peace of thoughts.

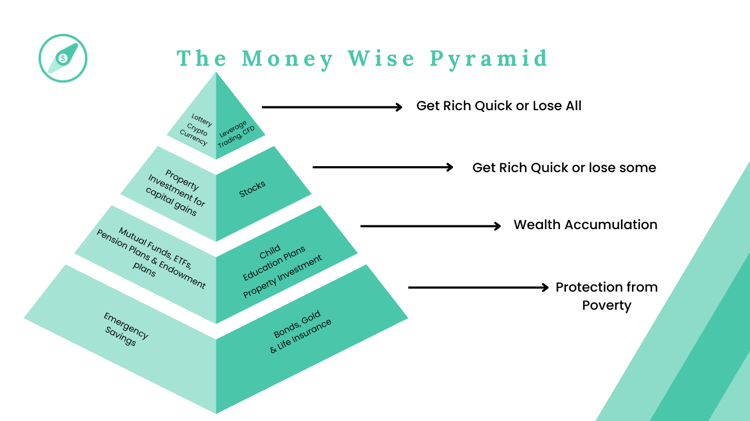

The Monetary Planning Pyramid and Life Insurance coverage

Life Insurance coverage offers a strong base to your monetary plan, enabling you to work in your desires and objectives, realizing that your loved ones’s monetary future is safe.

It helps your efforts in creating a robust monetary basis for your loved ones.

Who Wants Life Insurance coverage in UAE?

- Singles: Even with out dependents, securing low premium life insurance coverage at a younger age is prudent to guard in opposition to lack of revenue as a result of essential sickness and incapacity.

- Newly Married {Couples}: Joint monetary planning turns into essential, and life insurance coverage safeguards in opposition to the surprising.

- Households with Younger Kids: It is vital for each mother and father to have life insurance coverage to cowl all eventualities.

- Single Mother and father: It is important to have sufficient protection to safe your kid’s future.

- These with Older Kids: Life insurance coverage stays essential to assist your partner and youngsters to keep up their way of life.

- Retirees: To keep away from burdening your youngsters or partner, life insurance coverage can cowl property taxes or create a legacy.

Life Insurance coverage for Enterprise House owners in UAE

For enterprise house owners, life insurance coverage is essential for the continuity of the enterprise and monetary safety of workers and companions. KeyMan Insurance coverage or Companions Insurance coverage is very vital.

Get Began with Life Insurance coverage in UAE

Occupied with life insurance coverage?

It is simpler and extra inexpensive than you’d think about!

I’m right here that will help you discover the right match to your life’s distinctive safety wants

Attain out at the moment to start out this vital dialog.

[ad_2]