[ad_1]

Again a few months to the chapter of Amyris and ahead to now with an public sale for JVN hair – winners for this specific model are Windsong International who paid $1.25 million. That isn’t some huge cash in magnificence M&A phrases. A bid of $3 million for Menolabs from Dr Reddy’s Laboratories took it. Rose Inc (Rosie Huntingdon-Whitely’s magnificence model) went to AA Investments for $2.5 million and THG paid $20 million for Biossance. Lastly, Naomi Watts purchased again her personal holistic menopause model, Stripes, for $500,000.

The enterprise capital arm of ELC has purchased a stake in Soften Season, a Chinese language luxurious perfume model. Different Chinese language perfume manufacturers to look out for are Paperwork and To Summer time catering to Chinese language identification and utilizing famend noses to create their scents. Paperwork opened a Shanghai stand alone retailer and has since launched on Web A Porter – it’s solely a matter of time earlier than we see the Chinese language perfume market make inroads within the UK.

Uoma Magnificence is at the moment in a multitude – what it seems to be like is that enterprise capitalists, MacArthur Firms Firms (and particularly their new magnificence arm MacArthur Magnificence), most prominently recognized for investments in property, have staged what is likely to be known as a hostile take-over to acquire the model. In keeping with founder, Sharon Chuter, she solely knew her model had been taken over after the occasion. Uoma garnered complaints from clients for unfulfilled orders over the summer season and their social media accounts weren’t up to date. It’s not typically I hear of magnificence manufacturers being taken over this fashion – it’s disappointing notably as a result of Uoma is a model with range on the very core and that’s one thing the sweetness trade is actively seeking to promote and help. I’d be extraordinarily eager to understand how MacArthur intends to nurture the center of this model, and by that I imply range.

Excellent news for Sephora followers – a brand new retailer is deliberate within the Trafford Centre, Manchester, for subsequent yr.

I can’t faux to know magnificence financials in any means apart from essentially the most floor potential, however Unilever is within the information for a number of barely conflicting causes. They’ve bought off their ‘non-core’ offshoot, Elida magnificence (amongst others, homeowners of Q Ideas, Timotei and Tigi) to enterprise capitalists Yellow Wooden. Elida’s USP was to disrupt basic manufacturers and convey them from the previous to the current to seize completely new audiences. Over in NYC, Unilever has laid off 169 staff from two of their manufacturing vegetation (beforehand owned by Sundial manufacturers and bought by Unilever in 2017) with manufacturing of magnificence and private care being moved elsewhere. Redundancies appear to be throughout the board at Unilever simply now – it’s not simply NYC being affected by this however a lot nearer to dwelling, too. So, to then skip to Unilever ventures, the enterprise capital arm of Unilever – they’ve simply backed a 4 million Australian greenback seed spherical for Australian hair care model, Straand, recognized for its use of probiotics to enhance scalp well being. On the identical time, Unilever has simply purchased the hair model, K18 for an as but undisclosed quantity. General, Unilever has carried out properly this yr however lay-offs from a financially wholesome firm by no means look good.

It might not be a BBN with out a little class motion motion! This time, it’s Estee Lauder Firms going through a category motion within the US Court docket for the Southern District of New York. The lawsuit covers ‘all individuals and entities who purchased or acquired Estee Lauder frequent inventory between August 18th 2022 and Could 2nd 2023’. The declare is that false and unrealistic statements relating to demand and stock have been made by Estee Lauder that lead traders to consider their share purchases have been a stable funding. All of it centres round a big and sudden share worth drop on Could 2nd which led to a lower within the fiscal yr outlook. Will probably be attention-grabbing to see how this one performs out.

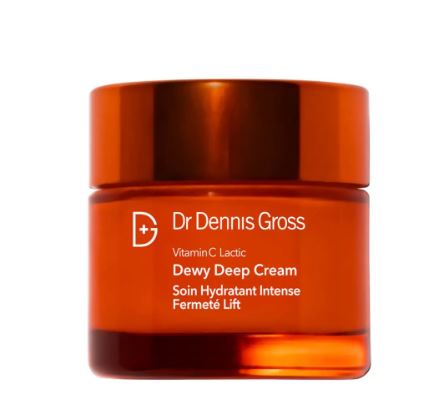

Shiseido has purchased skincare model Dr Dennis Gross, regardless of posting its greatest revenue drop in 16 years. It’s attention-grabbing to notice that one of many causes that Shiseido has supplied is that Chinese language curiosity in Japanese model has not been as excessive as anticipated. Japan launched (reportedly protected) handled radioactive water into the Pacific in August which infuriated the Chinese language as a result of they imported a lot seafood from Japan which has now been drastically lower. Larger image is that China will not be wanting favourably at Japan which has affected gross sales and imports in all areas. That stated, Shiseido is seeking to the Indian marketplace for its massive bucks (together with many different manufacturers) – it’s simply opened a NARS retailer and a Shiseido retailer there. Shiseido has additionally simply launched its personal capital fund – Shiseido Lengthy Time period Investments For The Future seeking to discover early stage potential amongst rising manufacturers.

Transparency Disclosure

All merchandise are despatched to me as samples from manufacturers and businesses except in any other case acknowledged. Affiliate hyperlinks could also be used. Posts should not affiliate pushed.

[ad_2]